tax service fee fha

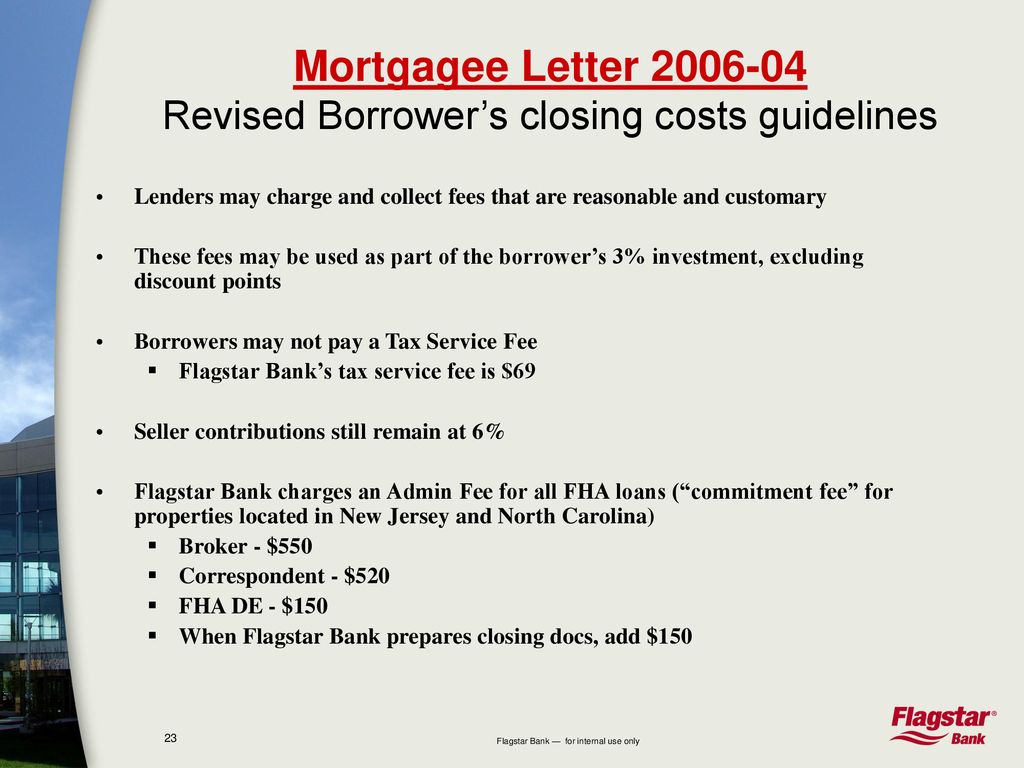

The one percent fee cap was eliminated for loans originated after that time but the FHA does not allow the lender to charge a tax service fee. Any Messenger Fee incl.

Tax Service Fees For Va Fha Loans Hud Handbook

Start wNo Money Down 100 Back Guarantee.

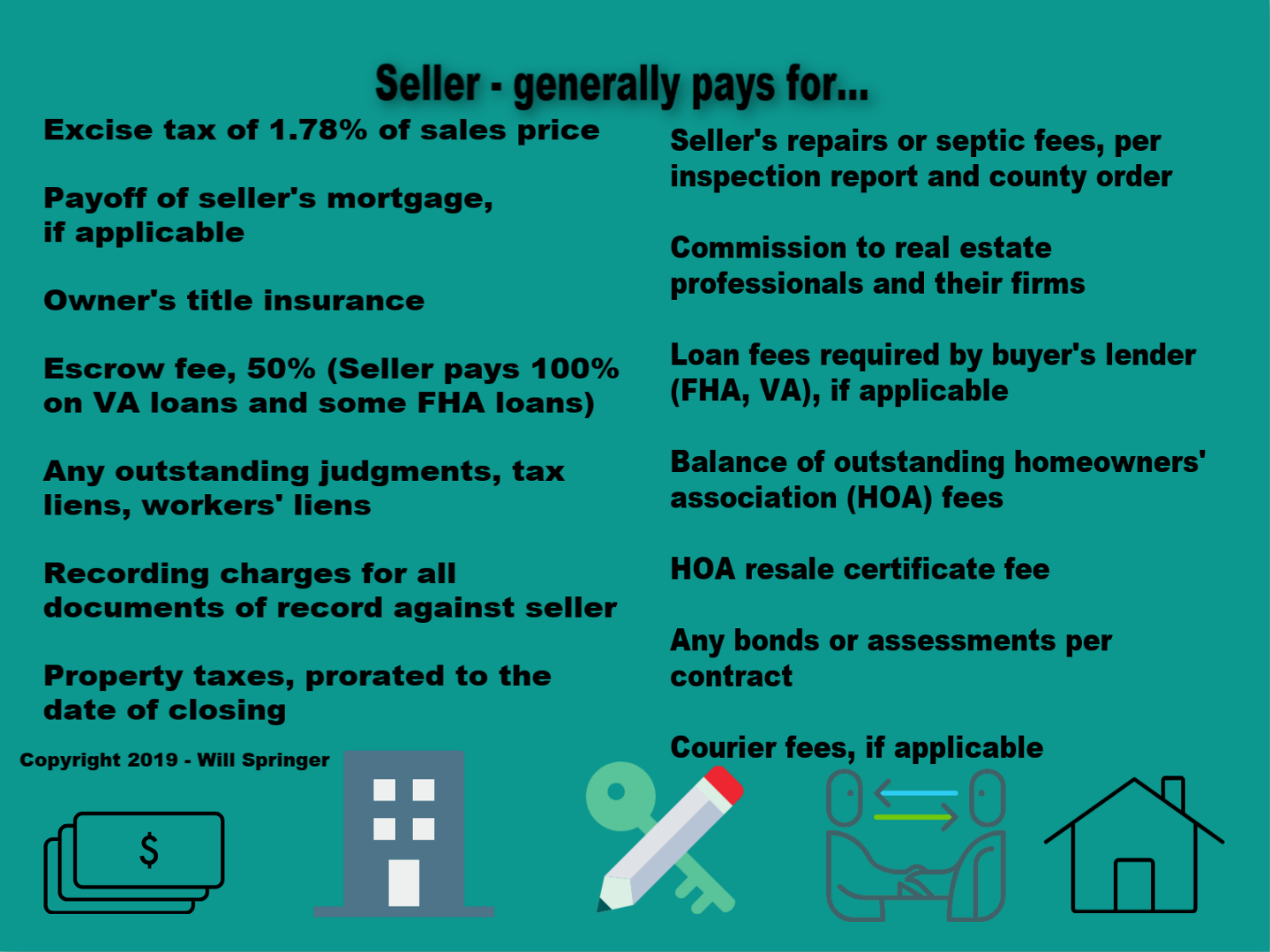

. How Does a Tax Service Fee Work. We are experienced tax professionals. The seller or lender must pay the non-allowable tax service fee which typically costs about 25 to 75 according to the Good Mortgage website.

For sure Customer X was incredibly delighted that he did not really need to pay any funds for the Inner Profits Services and only had to pay a small modest charge to me to avoid wasting him. What is a tax service fee FHA. According to the National Society of Accountants the average fee in 2020 for preparing Form 1040 with Schedule A to itemize personal deductions along with a state.

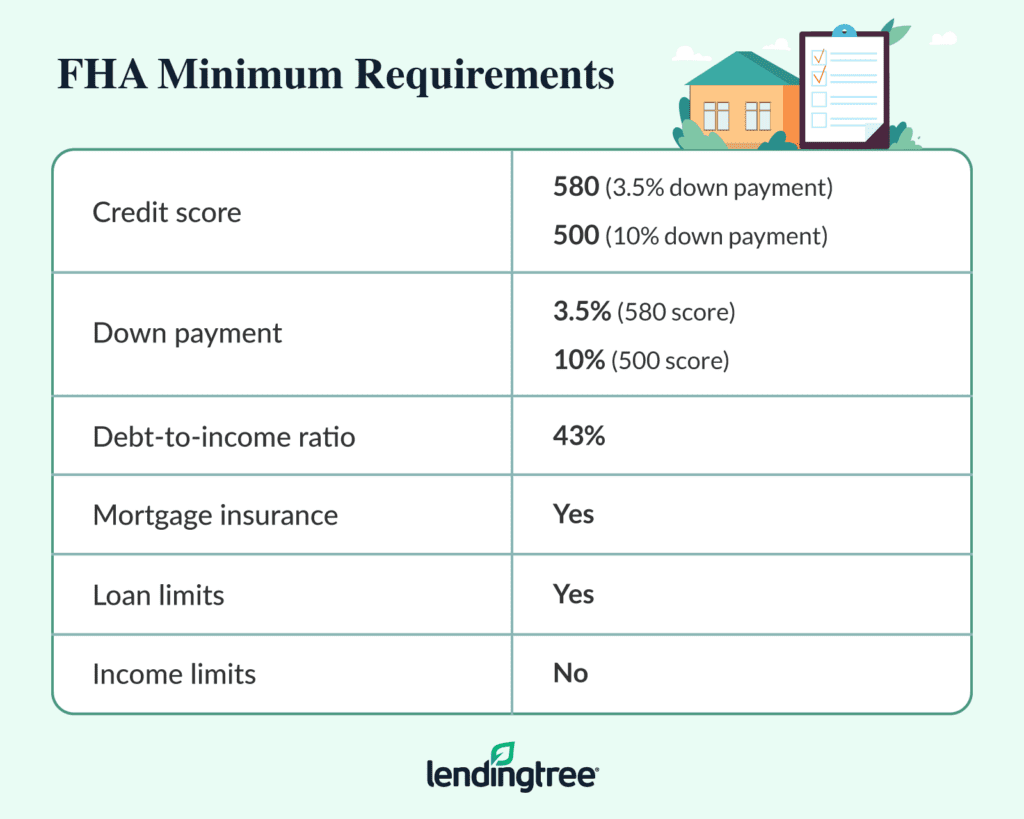

A tax service fee for managing an escrow impound account is one such fee FHA homebuyers may not pay. Tax service fees are closing costs that are assessed and collected by a lender as a means of making sure that mortgage holders pay property taxes in a timely manner. A tax service fee directly benefits the loan servicing company or the.

Can you charge a tax service fee on an FHA loan. Many Options Great Rates With FHA. The seller or lender must pay the non-allowable tax service fee which typically costs about 25 to 75 according to the Good.

The FHA rules are designed to give clear guidance. Tax Service Fee 50 This fee is paid to research the existing property taxes for the property and to see whether the taxes have been paid to date. Termite Fees or Work Charges.

Claims Module interested parties should contact the. According to the National Society of Accountants the average fee in 2020 for preparing Form 1040 with Schedule A to itemize personal deductions along with a state. Fha Loans For Borrowers With Tax.

Tax Service Fee 50 This fee is paid to research the existing property taxes for the property and to see whether the taxes have been paid to date. Most lenders charge underwriting fee for the service of evaluating the loan application for approval. What is a tax service fee FHA.

Todays 10 Best FHA Loans Comparison. The gist of the questioncan an FHA. A tax service fee is paid by mortgage borrowers to mortgage lenders to ensure that a mortgaged propertys property taxes are paid on time.

Recording Fee - Balance above 1700. The one percent fee cap was eliminated for loans originated after that time but the FHA does not allow the lender to charge a tax service fee. A processing fee is charged to cover documentation.

Fha Funding Fee Is An Fha Loan Worth It

What Is A Loan Estimate How To Read And What To Look For

Fha Loans Escrow Accounts And Real Estate Taxes

Mortgage Escrow What You Need To Know Forbes Advisor

Cheap Discount Mortgages Brokers Are Better In 2022 Mortgage Mortgage Banker Mortgage Brokers

What Are Fha Loan Closing Costs The Ascent By Motley Fool

The Fha Home Loan Process Step By Step Cis Home Loans

What Is An Fha Loan And What It Does For You Pros And Cons Better Mortgage

What Are The Estimated Prepaid Items On An Fha Loan

Fha Loans Houston Rock Mortgage Houston

Closing Costs South Carolina How Much Are Closing Costs In South Carolina Calculator Attorney Fees Tansfer Tax Title Insurance Cain Mortgage Team

Working With Escrow The Settlement Statement Will Springer

Fha Closing Costs What They Are And How Much They Cost Bankrate

Stacy Fellows The Hupp Group At Keller Williams Island Life Venice Fl Look At What Mercurybuilds Is Offering Zero Closing Costs When You Use A Preferred Lender Core Bank Take

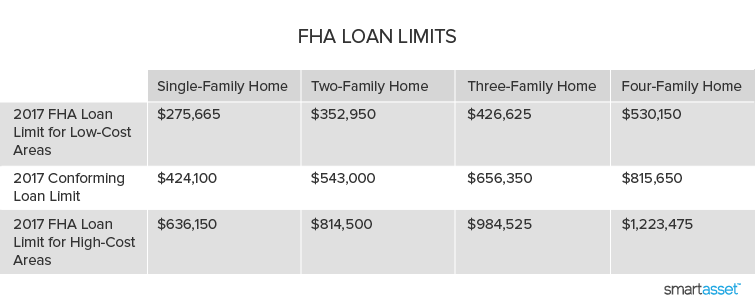

Fha Loan Limits 2022 Update With County Maximums Smartasset Com

Presenting The Fha Product Workshop Ppt Download